Affinity Capital’s Market Outlook for the New Year

U.S. stocks have continued to climb amid optimism about a vaccine-led economic recovery, but it is a narrow path—buoyant investor sentiment could easily be deflated by bad news. Although global economic growth has struggled, an acceleration in vaccinations in major countries could support stronger growth in the second quarter.

Meanwhile, after months of languishing near record lows, 10-year Treasury yields have risen to their highest level since March 2020, as the bond market focuses on the potential for stronger growth and higher inflation in 2021.

U.S. stocks and economy: Persistent sentiment risk

Optimism remains strong for an economic rebound, as COVID-19 vaccinations continue to roll out. However, with the pace of vaccinations lagging original projections and the virus continuing to spread at record and alarming rates, growth will likely struggle in the near term. Ultimately, herd immunity still represents the light at the end of the tunnel, but the path forward is darkened by efforts to mitigate the spread of the virus.

The labor market faces persistent headwinds. The December U.S. employment report showed a loss of 140,000 nonfarm payroll jobs, the first decline since April 2020. More sectors added jobs than eliminated jobs, but the leisure/hospitality sector took a big hit, accounting for nearly 500,000 job losses. Despite some overall bright spots, U.S. payrolls still have meaningful ground to make up, as we are almost 10 million jobs short of pre-pandemic levels.

The labor market’s recovery momentum has slowed

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics (BLS), as of 12/31/2020.The overall slowdown in the economy has been a side effect of the continued spread of the virus, which has prompted renewed regional lockdowns and restrictions. As a result, consumers have tightened spending in certain areas, which has in turn hurt businesses—especially those in the services sector—and their prospects for survivability.

Meanwhile, the stock market has continued to climb, with some choppiness, as investors look forward to a vaccine-driven recovery, even though recent economic data has been less exciting. This disconnect is reflected in the U.S. Citi Economic Surprise Index, which has continued to decline. The index measures incoming economic data relative to expectations, with a positive reading reflecting stronger-than-expected results and a negative reading the opposite (note: as the economy emerged from the depths of the crisis, the index spiked to its highest level on record, simply due to economists’ inability to accurately forecast the hit from the pandemic).

The Citi Economic Surprise Index has continued to decline

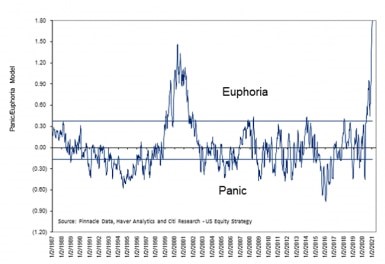

Source: Charles Schwab, Bloomberg, as of 1/13/2021.Conversely, Citi’s Panic/Euphoria Index, shown below, reflects extreme investor. The level has shot up way beyond that reached during the euphoric period of the late-1990s technology-stock bubble.

Nevertheless, investor sentiment is at euphoric levels

Source: Citi Research, Pinnacle Data, Haver Analytics, as of 1/9/2021.Because of the disconnect between investor sentiment and actual economic growth, sentiment is a persistent risk to stocks. A significant negative catalyst—in the form of virus-/vaccine-related bad news, a deterioration in fundamentals, or ongoing political turmoil—could spark a near-term downturn. For now, though, momentum and liquidity remain the driving forces for the market’s climb higher.

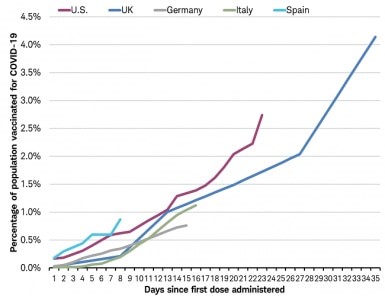

Global stocks and economy: A slow start

Global economic growth is struggling as 2021 gets underway, with COVID-19 infection rates and fatalities continuing to rise as countries accelerate the rollout of vaccination programs. With several countries having administered first-dose inoculations to only about 3%-5% of their populations within the first month of the programs, lockdowns are likely to remain in place and skew economic data to the downside in the first quarter. However, we expect the pace of the vaccine rollout to pick up, with 50% or more of the population in major countries likely to receive the first vaccine dose by the end of the second quarter. This may begin to provide a sharp restart to growth starting in the second quarter.

Vaccinations off to a slow start

Source: Charles Schwab, reports from government officials in referenced countries. Data as of 1/11/2021.We believe a new economic cycle is beginning as the global economy emerges from the virus-induced economic downturn. This could lead to outperformance by international stocks supported by better economic growth, lower equity valuations, and a weaker U.S. dollar.

Market leadership tends to last for many years, even a decade, before reversing at the start of a new cycle. For example, after international stocks outperformed in the 1980s, the 1990 recession saw a shift to U.S. stock outperformance. The 2001 recession saw a switch back to international outperformance, and the 2008 recession flipped the switch again to U.S. outperformance. And now, the start of a new cycle may once again signal a switch to international stocks.

Annualized performance by economic cycle

Dates reflect economic cycle peaks defined by the National Bureau of Economic Research. Annualized total return between cycle peaks measured by MSCI USA Index and MSCI EAFE Index.Source: Charles Schwab, Bloomberg data as of 1/11/2021. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

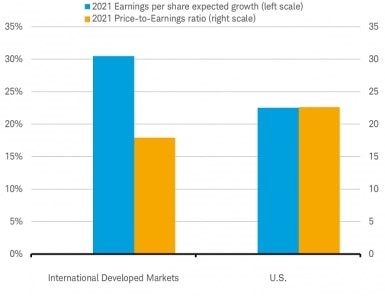

This may continue as the new economic cycle strengthens. International economic and earnings growth is expected to outpace that of the United States and valuations are currently at extremes between U.S. and international stock markets, as you can see in the chart below. Both forward and trailing price-to-earnings ratios have a considerable, above-average spread of 4-5 points between U.S. and international markets, implying a relative overvaluation for U.S. stocks that may foster longer-term outperformance by international stocks.

International valuations appear relatively attractive

Source: Charles Schwab & Co, FactSet, as of 1/11/2021. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.Since the end of April of last year, when global economic data appeared to have hit the low point for the cycle, international stocks have been outperforming U.S. stocks. If global growth resumes, as we expect, it may bolster international equities’ outperformance in 2021.

Fixed income: Bond yields rise with inflation expectations

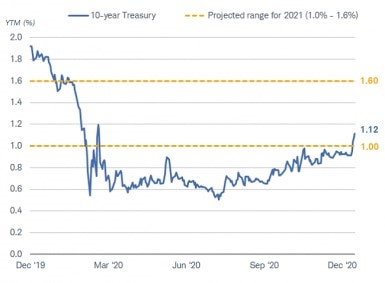

After months of languishing near record lows, 10-year Treasury yields finally pushed above 1%, the highest level since March 2020. It is striking that the move came in a week of unprecedented events in the Capitol and the weakest employment report in eight months. For better or worse, markets often seem out of sync with current conditions. In this case, the bond market is focused on the potential for stronger growth and higher inflation in 2021.

Ten-year Treasury yields exceed 1% for the first time since March

Source: Bloomberg. U.S. 10-year Treasury yield and the projected range for the 10-year in 2021 (USGG10YR Index). Daily data as of 1/8/2021.Three factors are behind this outlook:

- Hopes that vaccines will allow the economy to recover from the Covid-19 crisis.

- Expectations for expansive fiscal policy under the Biden administration.

- Signals from the Federal Reserve that it will maintain a very easy policy stance.

With vaccine distribution picking up, prospects for getting the pandemic under control are improving. There still appears to be a long way to go, but progress on getting large numbers of people vaccinated is being made, which should allow hard-hit sectors of the economy to begin recovering. Once it is safer for people to congregate, sectors like travel and hospitality, restaurants and bars, and schools can begin to return to normal activity. Stronger employment growth should follow.

The Biden administration, supported by a slim majority in Congress, has laid out ambitious plans for boosting economic growth, starting with spending to address the COVID-19 crisis. Direct aid to struggling households, small businesses, and local governments are all on the agenda. In addition, there is talk of infrastructure spending and debt forgiveness. Even if the spending falls short of the administration’s goal, it is significantly more than the market had priced in prior to the run-off elections in Georgia that tipped the Senate in favor of the Democrats.

The Fed continues to signal that it will keep its current policy stance in place until inflation rises above its 2% target level. Under its new framework, the Fed will not start to raise interest rates in advance of a rise in inflation. Instead, it intends to let inflation run above its target level in hopes of driving the unemployment rate lower.

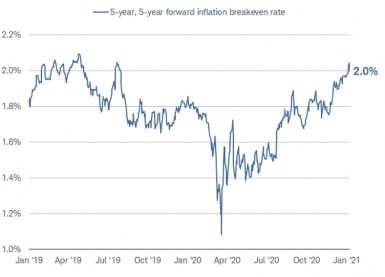

The combination of these three factors is driving inflation expectations higher. The implied inflation rate derived from the Treasury Inflation-Protected Security (TIPS) market has risen sharply in the past few months, signaling expectations that inflation will reach the Fed’s 2% target.

Inflation expectations continue to rise

Notes: A measure of the average expected inflation over the five-year period that begins five years from the date data are reported. The rates are comprised of Generic United States Breakeven forward rates: nominal forward 5 years minus US inflation-linked bonds forward 5 years.Source: Blomberg 5-year 5-year Forward Inflation Expectation Rate (USGG5Y5Y Index). Daily data as of 1/8/2021.

We continue to expect 10-year Treasury yields to move up to the 1.6% level in 2021, even while the Fed keeps short-term interest rates near zero. Our suggested strategy is to keep the average duration in a bond portfolio low to mitigate the impact of rising rates. We do not expect a big move up in inflation, but with “real” interest rates negative (that is, below the inflation rate) there is room for higher bond yields.

As always, please call us at Affinity Capital to discuss any further questions concerning your portfolios.

As we look forward to 2021, its time to review your current plan and discuss strategies that we may need to implement in the new year. We want to be certain that we fully understand the important issues that affect you and your family. This may include implementing a more tax efficient strategy, addressing retirement savings and distributions. We also want to be certain that all documents are up to date. We will be discussing this with you and your family in our year end meetings.

We appreciate your business and welcome your referrals!