Putting a Bow on 2022

Although 2022 was a year marked by memorable events, but any investors might wish they could forget it, considering one prominent gauge of U.S. stock market performance — the S&P 500® Index — ended the year in bear market territory.

Although each taxable account and each client are different, we strive for tax-efficiency annually. As we moved forward from year-end 2021, our forecasted market environment saw the need to significantly reposition our portfolios.

In the following Figure 1, we offer a look back across 2022, plotting the cumulative daily return for the S&P 500 along with a host of notable headlines.

Over these three years, there was news and changing conditions that contributed to market volatility. The pandemic, the ensuing economic shutdown, rising inflation and the Federal Reserve’s actions to fight it are just examples.

Affinity Capital exited positions early in 2020 as the scale of the COVID pandemic affected the markets. We slowly re-entered during the Dow Jones Industrial Average thousand-point drops.

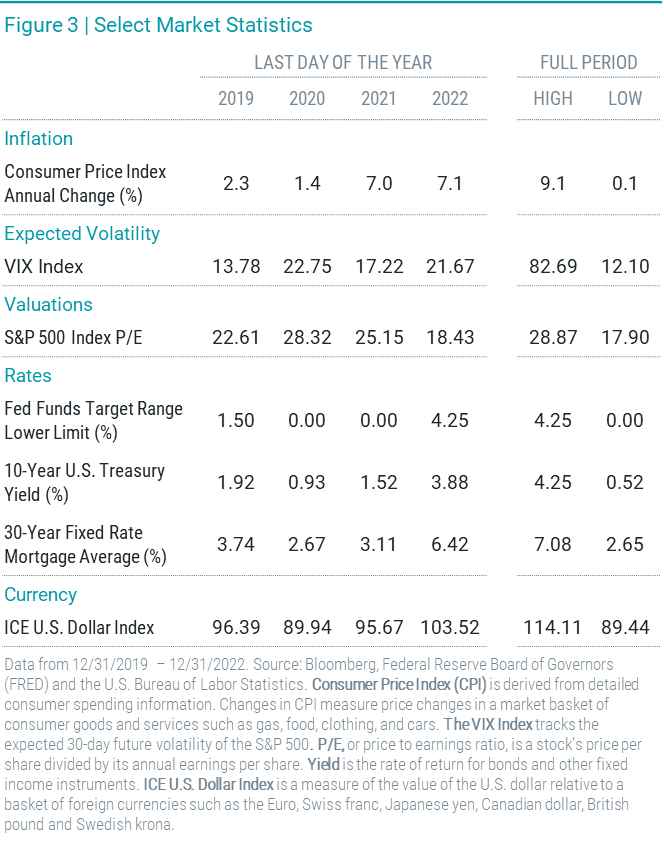

In Figure 3, we put the period in greater context by presenting a selection of notable statistics showing where each stood at the end of 2019 and each year since.

The full-period highs and lows helped to unmask the changes that were anything but linear. Between these three years, we saw times of higher volatility, higher stock valuations and lower interest rates than we saw at the end of 2022.

In the first quarter of 2022, we exited traditional bonds whose value is inversely affected by rising interest rates. We also exited small and mid-size company funds as well as international position and have moved to higher income producing securities to take advantage of climbing interest rates.

A Few Thoughts for 2023

Looking ahead, we will face many of the same risks and uncertainties of 2022 as it remains to be seen how far the Federal Reserve will go in its campaign to curb inflation, how higher interest rates will affect consumer spending and company earnings, how the war in Ukraine will play out, or what will result from China’s shift away from its zero-COVID policy.

History does offer perspective, though, for investing in tough times. We can expect more volatility in 2023, but the market has already priced in lower expectations, and valuation ratios are more attractive.

If we consider previous periods when economic uncertainty was high, the markets have historically rallied well before those uncertainties subsided — once light appeared at the end of the tunnel and signs of improving conditions were apparent. There is a possibility of continued weakness in the technology heavy Nasdaq 100 stocks. This may be another shoe to drop in the minus 10 to 15% range. As we realign our portfolios, we see periods of continued weakness in the short-term which will heighten investor emotions.

Just a year ago markets were at historic highs after a century of world wars, assassinations, oil embargos, terrorist attacks, a mortgage crisis and so much more. The markets are resilient and will continue to build wealth for us.